CLARIFICATION: NO PIPELINE WAS SHUT DOWN, NO OIL STOPPED FLOWING

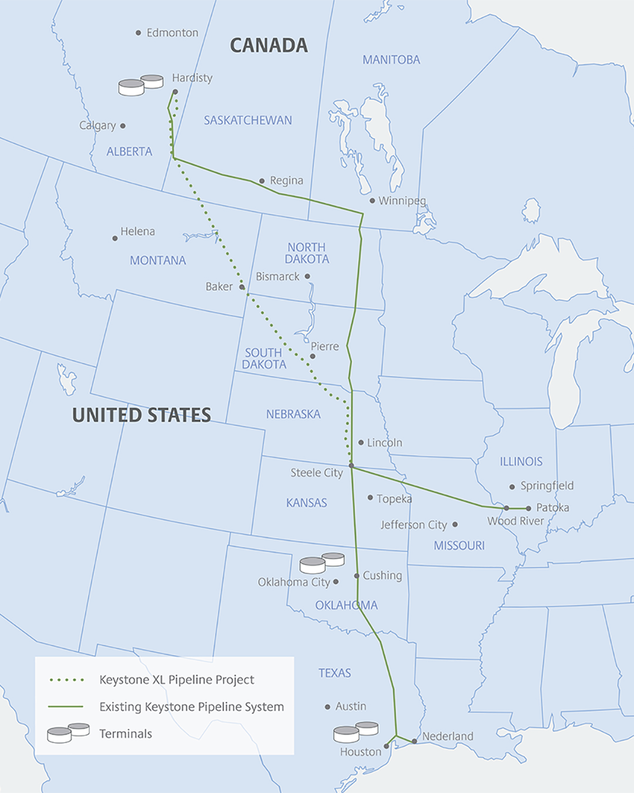

One of President Joe Biden’s first official acts effectively halted construction of the Keystone XL pipeline, which was designed to help carry up to 830,000 barrels per day of crude oil from Canada to the Gulf Coast once it was to be completed potentially by 2023. Currently, the Keystone XL Pipeline has been constructed about 300 miles out of the 1,210 miles planned. Keystone XL should not be confused with the existing Keystone Pipeline which has been operational for some time now. Keystone XL is just an ‘extension to the Keystone pipeline

Does his executive order make oil more costly for average Americans?

A Facebook post, appearing eight days after the order, claimed: “Stopping the pipeline did not change our use of oil. It just made oil more expensive for us to use. Thanks Joe!! What an idiot!!!”

The post was flagged as part of Facebook’s efforts to combat false news and misinformation on its News Feed. (Read more about our partnership with Facebook.)

There’s no evidence yet that Biden’s decision, which fulfilled a campaign promise dating back to at least May 2020, triggered any spike in oil prices that affects consumers now. For one thing. The pipeline in question isn’t even built yet. Contruction just started last year and about 300 miles has been completed. But there are nine-hundred more miles to go.

But what about the impact over time? We talked to several experts to gauge what effect Biden’s order might have on future prices consumers pay for refined oil products like gasoline, diesel or heating oil.

Some said that given constant demand, taking away the pipeline option would make transporting crude oil less efficient and more costly, at least for producers.

But most of them said they doubted that those higher costs would make their way to U.S. consumers, given where the Canadian oil was likely headed, and how the oil markets operate.

The Keystone XL pipeline, first proposed more than a decade ago, was to have transported crude oil from Alberta, Canada, to Steele City, Neb., where it would connect with the already existing pipeline stretching to Gulf Coast refineries.

The Trump administration backed the project in the face of objections from environmental groups. The company building it announced in March 2020 that it was launching construction, saying it would invest $8 billion in the project, with service expected to begin in 2023. But the project was stalled again by litigation over environmental concerns.

Biden’s order revoked the pipeline’s construction permit. He said the pipeline would “not be consistent with my administration’s economic and climate imperatives.”

For two benchmark products, the price of oil trended downward in the time between Biden’s order and the Facebook post.

The price of West Texas Intermediate crude oil on the spot market was $53.16 per barrel on Jan. 20, according to the U.S. Energy Information Administration. It was lower each day between then and Jan. 28, the date of the Facebook post, when it was $52.26. The price of Europe Brent was $55.66 per barrel on Jan. 20. It rose 2 cents the next day, but then was lower each day and was $54.87 on Jan. 28.

The U.S. Energy Information Administration and the Department of Energy told us they had no analyses on what suspending the pipeline might do to prices.

Several energy economics experts we talked to said they saw no evidence that Biden’s order has already had an impact on the cost of oil, particularly for consumers.

Because the pipeline “would not be available for some time, I do not see how the Biden decision could have already affected the price of oil for consumers,” said Jay Hakes, administrator of the EIA during Bill Clinton’s presidency. “If there is any long-term impact on prices at the pump, the change would be very small and unnoticed by customers.”

Jeff Smith

March 9, 2021 at 6:57 pm

Why did gas prices go up by almost 60 cents per gallon in less than 2 months after Biden took office??? Hey fact checkers where are you??? Urinate down sombody eles’s back and tell themit is raining…

Frank White

March 10, 2021 at 7:25 am

Up almost 80 cents here in upstate New York

Anonymous

March 10, 2021 at 7:29 am

The DEMON-RAT’S always want you to believe whatever they tell you. PAY no attention to the man behind the curtain

Anonymous

March 23, 2022 at 10:04 pm

Bull shit Biden cause of all inflation!

Military Veteran

April 15, 2022 at 3:34 pm

All about the blame game!!! Refineries are price gouging all of us. They do it every time the world sneezes! Check their profits and stock prices! Do you think that you’d be better off with the narcissistic conspiracy insane Putin-Hitler idiot in the pilothouse? If so, you need to move to Russia or China or stop driving and take a bus!! His audiences are dropping off considerably! Because it’s a big Fairy Tale! It’s funny to keep seeing the paid cardholders behind him! I think they’re too young to even vote!!